Legislative Changes for Freelancers (Individual Authorized Persons/ Sole Trader/ PFA) in 2024

Legislative Changes for Freelancers (Individual Authorized Persons/ Sole Trader/ PFA) in 2024

The year 2024 brings a series of fiscal legislative changes concerning Individual Authorized Persons PFAs, which will result in an increase in the amount of tax obligations to the state budget.

The year 2024 brings a series of fiscal legislative changes concerning Individual Authorized Persons PFAs, which will result in an increase in the amount of tax obligations to the state budget. These fiscal adjustments will require better planning and management of PFA activities to cover all payment obligations and maintain a profitable business.

1. Transition from Flat Rate to Real System for PFA in 2024

The year 2023 brought a significant change regarding the threshold for applying flat-rate taxation. Thus, fiscal legislation established a reduction in the threshold from 100,000 euros to 25,000 euros. The consequence of these legislative provisions is that PFAs that recorded gross incomes exceeding 25,000 euros in the previous fiscal year will be obliged to switch to a real taxation system in the next fiscal year.

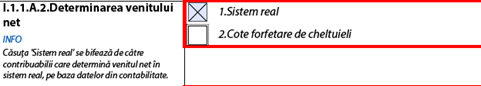

This transition from flat-rate to the real system for PFAs is achieved through the annual declaration, which must be filed by May 2024. This declaration establishes the taxation system for 2024 and declares other types of income for the preceding year, 2023. Regarding taxes for 2023, they will continue to be paid under the flat-rate regime.

Even though PFAs surpassing the 25,000 euros threshold in the previous year will be compelled to switch to the real taxation system for 2024, they will have the option to revert to the flat-rate system after a period of two years.

Under the real system of taxation, taxes are determined based on net annual income. Net annual income is obtained by deducting deductible expenses from total income. Consequently, PFAs transitioning to the real taxation system in 2024 will record both income and expenses.

2. Deductible Expenses for PFAs in 2024

As previously mentioned, taxes for PFAs under the real system of taxation will be applied by relating them to net income, calculated by deducting deductible expenses from receipts. Therefore, PFAs will have to record both receipts and deductible expenses.

According to Article 25 of the Fiscal Code, deductible expenses are considered to be those incurred for the purpose of conducting economic activity, including those regulated by current normative acts, as well as registration fees, contributions, and contributions due to chambers of commerce and industry, employers' organizations, and trade unions. Also, expenses for salaries and those assimilated to salaries, as well as expenses incurred by the employer for activities performed in telecommuting mode for employees working in this regime, fall into the category of deductible expenses.

To be considered deductible expenses, the following conditions must be cumulatively met:

- They must be based on supporting documents.

- They must be related to the object of the PFA's activity.

- They must be incurred for the purpose of generating taxable income and lead to taxable income.

- They must be incurred without exceeding the limits allowed by law.

- They must meet the conditions provided by law to be deducted from taxable income for the purpose of determining taxable profit.

3. Income Tax for PFA in 2024

For the income tax realized in 2024 within a PFA, the same rate of 10% applies, whether for activities taxed in the real system or at the flat rate.

It should be noted that the concept of net income in the real system refers to the amount resulting from subtracting deductible expenses from the total income earned during a fiscal year.

Despite the unfavorable legislative changes for PFAs in 2024, we can still identify regulations that present benefits, at least regarding the taxes that PFAs must bear.

Until 2024, only the CAS contribution (pension contribution) represented a deductible expense for the holder of a PFA in terms of tax benefits. With the legislative changes this year, the CASS contribution will also be included in the category of deductible expenses.

Thus, although the new legal norms essentially imply an increase in the level of contributions for a PFA, by reducing the taxable base through the possibility of deducting CASS, PFAs will pay a lower income tax. Such a measure is welcome, aiming to ensure a balance between expenses and incomes derived from independent activities.

Finally, as mentioned, the new tax methods will only apply to incomes earned in 2024, and contributions determined according to recent legislative changes will be paid upon the submission of the single declaration in May 2025.

4. CAS (Social Security Contribution) in 2024

The new regulations do not foresee changes regarding the CAS contribution for a PFA, so the same thresholds applied in 2023 concerning the obligation to pay pension contributions will be maintained.

Therefore, to the extent that income obtained from independent activities falls between 12 and 24 minimum wages per economy, the CAS calculation base cannot be lower than the equivalent of 12 minimum wages. However, if the income exceeds 24 minimum wages, in this case, CAS will be paid in an amount equal to 24 minimum wages per economy.

It is important to note regarding the pension contribution that the percentage applied to its calculation base is 25%.

5. CASS (Health Insurance Contribution) in 2024

Regarding CASS, a new calculation basis will be applied to taxes that freelancers must pay. Consequently, starting in 2024, this organizational form will no longer be as advantageous, considering this contribution.

It is important to note preliminarily that we refer to payment obligations for the 2024 fiscal year, meaning obligations related to incomes earned in 2023, which are to be paid by May 25, 2024, are not subject to the new regulations.

Beginning with the 2024 fiscal year, a new method for calculating CASS will be implemented. The determination of this contribution will no longer aggregate incomes from independent activities obtained through PFA with other types of incomes, such as those from rents, dividends, interests, copyrights, and the like. Instead, the CASS amount will be determined by relating it separately to each of these income sources.

For calculating the health insurance contribution, taxpayers must apply a 10% rate to the annual calculation base.

Therefore, although the 10% rate remains unchanged, changes have been implemented regarding the annual calculation base. The contribution will now be calculated by applying this percentage in relation to two new thresholds:

- Minimum threshold of 6 gross minimum wages: In 2024, PFAs with an annual income below 19,800 lei (6 x 3,300 lei) will pay a contribution consisting of CASS in the amount of 1,980 lei.

- Maximum threshold of 60 gross minimum wages: In 2024, PFAs with an annual income exceeding 198,000 lei (60 x 3,330 lei) will pay a contribution consisting of CASS in the amount of 19,800 lei.

- For annual incomes between 6 and 60 minimum wages, each PFA will pay 10% of this income as CASS.

If a sole proprietorship (PFA) also has an employment contract in parallel, they will pay the 10% contribution based on net income, even when the amount received does not exceed the threshold of 6 minimum salaries in the economy.

Moreover, if, before these legislative changes, both annual incomes obtained as PFA and those from other sources were included in the CASS cap calculation, from 2024 onward, the latter will be calculated separately and capped differently. Therefore, if in 2024 a PFA earns incomes from other sources, such as rents, dividends, or interests, the CASS contribution will represent 10% of 6, 12, or 24 gross minimum wages.

As we navigate the intricate landscape of fiscal changes in 2024 for freelancers, it becomes evident that adaptability and strategic financial planning are very important. The increased obligations and recalibrated tax structures require a meticulous approach to ensure not only compliance but also the sustenance of a profitable venture.

As these legislative changes take effect, it becomes imperative for freelancers to engage with financial professionals, staying informed about nuances that may impact their specific circumstances. The adaptability of freelancers, coupled with informed financial strategies, will undoubtedly be instrumental in navigating the evolving fiscal terrain of 2024 and beyond.